When you pick up a prescription, you might not realize the drug you’re getting was chosen for you - not just by your doctor, but by your insurance company. Behind the scenes, insurers use something called a preferred generic list to decide which medications are cheapest for them to cover. And that decision directly affects what you pay at the pharmacy counter.

These lists aren’t random. They’re carefully built by teams of doctors and pharmacists who review every drug based on safety, how well it works, and most importantly - how much it costs. The goal? Get you the same treatment at a fraction of the price. The FDA says generic drugs cost 80-85% less than brand-name versions. When six or more companies make the same generic, prices can drop as much as 95%. That’s not just savings for insurers - it’s savings for you.

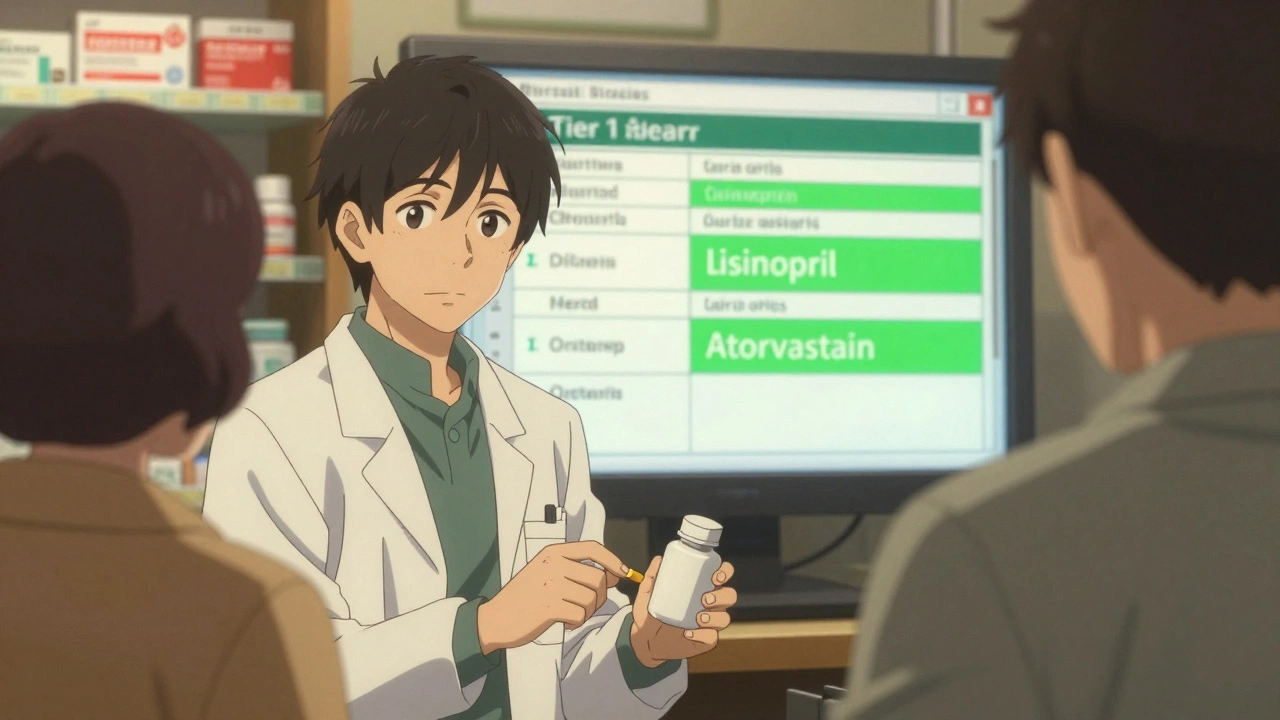

How Drug Tiers Work: What You Pay Depends on the List

Insurers don’t just say “use generics.” They organize drugs into tiers - like levels in a pricing game. Most plans use three to five tiers, and your out-of-pocket cost changes with each one.

- Tier 1: Preferred generics. These are the cheapest. You’ll usually pay $5-$15 for a 30-day supply. Think blood pressure meds like lisinopril, cholesterol drugs like atorvastatin, or thyroid medicine like levothyroxine.

- Tier 2: Preferred brand-name drugs or higher-cost generics. Copays jump to $25-$50. Sometimes, a brand-name drug is placed here if it has better evidence or fewer side effects.

- Tier 3: Non-preferred brands. These cost $50-$100. Insurers don’t encourage these unless there’s no generic alternative.

- Tier 4: Specialty drugs. Biologics like Humira or Enbrel. These can cost hundreds or even over $1,000 a month. Coinsurance (a percentage of the price) is common here, not a flat fee.

Medicare Part D plans - which cover over 40 million Americans - almost all use four tiers. Commercial insurers follow the same pattern. The kicker? Even if a brand-name drug and its generic are in the same tier, the brand’s list price is still nearly double. But because copays are flat, you might pay the same $25 whether you get the generic or the brand. That’s why insurers push generics: they get the same result for less money.

Why Insurers Love Preferred Generics - And How It Saves Billions

It’s simple math. In 2023, 90% of all prescriptions filled in the U.S. were generics. But those generics made up only 23% of total drug spending. That gap? It’s where the savings live.

Pharmacy Benefit Managers (PBMs) - the middlemen between insurers and drugmakers - negotiate hard on pricing. For brand-name drugs, they get rebates of 25-30%. For generics? They buy in bulk directly from manufacturers and get even steeper discounts. CVS Health, UnitedHealth’s OptumRx, and Cigna’s Evernorth control nearly 80% of the PBM market. They don’t just pick generics because they’re cheaper - they pick them because they can control the supply chain.

That system saves the U.S. healthcare system $1.68 trillion a year, according to Harvard Medical School. But here’s the catch: those savings aren’t always passed to you. Some plans use coinsurance instead of flat copays. If your plan charges 30% of the drug’s price, and the brand costs $1,300, you pay $390. The generic at $200? You pay $60. That’s a $330 difference - just for one month.

The Hidden Problems: When Generics Don’t Work as Expected

Not every drug is easy to swap. For chronic conditions like high blood pressure or diabetes, generics work just as well. But for some drugs, doctors hesitate.

Take warfarin, a blood thinner. The American College of Clinical Pharmacy found that 23% of physicians avoid switching patients to generics because small differences in how the drug is absorbed can affect blood clotting. It’s not about effectiveness - it’s about stability. One bad switch can lead to a stroke or dangerous bleeding.

Then there’s the biologics problem. Drugs like Humira treat rheumatoid arthritis, Crohn’s disease, and psoriasis. Biosimilars - cheaper versions of biologics - are now available. But here’s the twist: brand-name makers offer co-pay cards that cut your bill to $5 or $10 a month. Biosimilar makers? They don’t. So even though Amjevita (the biosimilar to Humira) costs less, your out-of-pocket might be higher because you lose that assistance.

One Reddit user, u/BiologicPatient, reported paying $1,200 for Humira versus $850 for Amjevita - not because the drug was more expensive, but because their co-pay card disappeared. That’s not a glitch. It’s a business model.

What You Can Do: Navigate the System to Save Money

You don’t have to accept whatever your insurer picks. Here’s how to fight back - and win.

- Check your formulary every year. During open enrollment, log into your plan’s website and search your meds. If your drug moved from Tier 1 to Tier 3, your bill could double. Switch plans if needed.

- Ask your pharmacist. In 89% of states, pharmacists can swap a brand for a generic unless your doctor writes “dispense as written.” Many patients don’t know this. Ask before you leave the counter.

- Appeal denials. If your insurer denies coverage for a non-preferred drug, your doctor can submit a prior authorization request. According to the Kaiser Family Foundation, 68% of these appeals are approved when backed by medical evidence.

- Use GoodRx or SingleCare. These apps show cash prices. Sometimes, paying cash for a generic is cheaper than using insurance - especially if you haven’t met your deductible.

Patients who spend just 45 minutes a year reviewing their formulary save an average of 32% on meds. That’s over $400 a year per prescription, based on CMS data.

The Big Shift Coming: Biosimilars and Value-Based Tiers

Change is coming fast. Starting in 2025, Medicare Part D plans must place biosimilars in the same tier as their brand-name counterparts. That means no more penalty pricing. Analysts predict biosimilar use will jump from 15% to 45% in just two years.

But there’s a roadblock. Many PBMs now use “accumulator adjuster” programs - which means your co-pay card payments don’t count toward your out-of-pocket maximum. So even if you’re using a biosimilar with a $5 co-pay, that $5 doesn’t help you reach your $2,000 cap under the Inflation Reduction Act. You’re still paying full price after that.

UnitedHealthcare already launched “value-based formularies” for diabetes drugs. Instead of just picking the cheapest, they now look at real-world data: which drugs keep patients out of the hospital? Which ones lead to fewer complications? That’s the future. Insurers won’t just care about cost - they’ll care about results.

Why This Matters to You

Your insurance company isn’t trying to hurt you. They’re trying to control costs so premiums don’t keep rising. But the system is complex, and the rules change every year. The more you understand how formularies work, the more power you have.

Generics are safe, effective, and save billions. But they’re not always the right fit. If your doctor says a brand-name drug is necessary, fight for it. If your copay jumps unexpectedly, question it. And if you’re on a biologic, always ask: Is there a biosimilar? Does it have a co-pay card? Is it in the same tier?

Knowing your formulary isn’t just about saving money. It’s about making sure you get the right treatment - without surprises at the pharmacy.

What is a preferred generic list?

A preferred generic list is a tiered drug list created by health insurers and pharmacy benefit managers (PBMs) that identifies generic medications they cover at the lowest cost. These drugs are placed in Tier 1 of the formulary, meaning patients pay the smallest copay - often just $5 to $15 - to encourage their use over more expensive brand-name drugs.

Why do insurance companies prefer generic drugs?

Insurers prefer generics because they cost 80-85% less than brand-name drugs, and sometimes up to 95% less when multiple manufacturers compete. This cuts overall drug spending dramatically, helping keep premiums and out-of-pocket costs lower for everyone. PBMs negotiate bulk discounts with generic makers, making these drugs the most financially efficient option.

Can I still get my brand-name medication if it’s not on the preferred list?

Yes, but it’s harder. Your doctor can submit a prior authorization request explaining why the brand is medically necessary - for example, if you had side effects from the generic or your condition is unstable. If approved, your insurer will cover it, but you’ll pay more. If denied, you can appeal - and 68% of appeals are successful with proper documentation.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to be bioequivalent to the brand - meaning they deliver the same amount of active ingredient into your bloodstream within 80-125% of the brand’s rate. Studies show 98.5% of generic approvals meet this standard. For most drugs, including blood pressure, diabetes, and cholesterol meds, generics work just as well.

Why are biosimilars harder to get than regular generics?

Biosimilars are cheaper versions of complex biologic drugs, but they face two big barriers. First, brand-name makers offer co-pay cards that reduce your cost to $0-$10, but biosimilar makers usually don’t. Second, many insurers still place biosimilars in higher tiers or use accumulator adjuster programs that don’t count your payments toward your out-of-pocket maximum. This makes them seem more expensive even when they’re not.

How often should I check my insurance’s drug list?

Every year during open enrollment. Insurers change their formularies frequently - sometimes moving drugs to higher tiers, removing them entirely, or adding new restrictions. Reviewing your list takes about 15 minutes but can save you hundreds or even thousands per year. Use your plan’s online formulary tool or call customer service.

What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay - like $15 for a generic. Coinsurance is a percentage of the drug’s price - like 30% of $500. Coinsurance can make brand-name drugs extremely expensive. For example, a $1,200 drug with 30% coinsurance costs you $360. The same drug as a generic at $200 with 30% coinsurance is only $60. That’s why insurers push generics: they reduce coinsurance pain.

Can I save money by paying cash instead of using insurance?

Yes, sometimes. If you haven’t met your deductible, or if your plan has high copays, paying cash through apps like GoodRx can be cheaper. For common generics like metformin or atorvastatin, cash prices are often under $10. Always compare your insurance price with the cash price before filling your prescription.

If you’re on long-term medication, understanding your formulary isn’t optional - it’s essential. The system works best when you’re informed. Don’t wait for a surprise bill. Know your tiers. Ask questions. And never assume your drug hasn’t changed - because it probably has.

Heidi Thomas

December 4, 2025 AT 18:05Insurers don't care about your health they care about their bottom line. Generics are fine until you're the one who gets the bad batch that makes you dizzy for a week and they won't cover the brand because 'it's not medically necessary' lol. They're playing a game and you're the pawn.

Alex Piddington

December 6, 2025 AT 00:56It's important to recognize that while cost containment is a necessary function of healthcare systems, the ethical responsibility lies in ensuring equitable access. The tiered formulary system, while economically rational, can inadvertently disadvantage patients with complex conditions. A balanced approach is essential.

Libby Rees

December 7, 2025 AT 03:12Most people don't realize their insurance company picks their meds. It's not just about saving money - it's about control. And honestly? It's kind of scary how much power they have over your health.

Rudy Van den Boogaert

December 7, 2025 AT 23:36I used to think generics were just cheaper versions of the same thing, but after my dad had a bad reaction to a generic blood thinner, I learned it's not always that simple. Some people need the brand. Doctors should have more say, not PBMs.

Jordan Wall

December 8, 2025 AT 16:33Let’s be frank: the PBM oligopoly is a regulatory capture nightmare. The vertical integration of CVS, OptumRx, and Evernorth creates perverse incentives - rebates are extracted from manufacturers, not passed to consumers, and formulary placement is less about clinical efficacy and more about margin arbitrage. The system is structurally broken.

Shofner Lehto

December 9, 2025 AT 09:37For anyone on chronic meds: check your formulary every year. Even if nothing changed for you, they moved something. I saved $280 last year just by switching my plan during open enrollment. It takes 20 minutes. Do it.

John Filby

December 11, 2025 AT 05:11My pharmacist once told me to ask for the generic even if my doctor didn't say so. I didn't know you could do that. Now I always ask. Saved me $40 a month on my cholesterol med. 🙌

Elizabeth Crutchfield

December 12, 2025 AT 09:22i had to pay 500 for my biologic last month and then found out the biosimilar was 300 but no copay card so i just kept paying the 500 cause i was too tired to fight it. feels like a trap.

Ben Choy

December 14, 2025 AT 05:10It’s wild how much we’re expected to navigate this mess alone. I’m just trying to stay healthy, not become a healthcare lawyer. But yeah, I do check my formulary now. Small win.

Emmanuel Peter

December 14, 2025 AT 05:27Stop pretending generics are always safe. The FDA allows 80-125% bioequivalence? That’s a 45% swing in absorption. That’s not medicine, that’s gambling with your kidneys. And don’t even get me started on PBMs - they’re the real villains.

Ashley Elliott

December 14, 2025 AT 22:40It’s frustrating, yes - but knowledge is power. I’ve learned to print my formulary every year, highlight my meds, and bring it to every doctor’s visit. I’ve had three prior auths approved. It’s a pain, but it works.

Chad Handy

December 16, 2025 AT 14:50Look, I get it - generics save money. But here’s the thing: I’ve been on Humira for 12 years. I switched to Amjevita because my insurer forced me. First month, I got a rash. Second month, my joints flared. My rheumatologist said, ‘You’re not a lab rat.’ I appealed. Got approved. Paid $1,200 a month. But I could walk again. The system doesn’t care about quality of life. It cares about line items on a spreadsheet. And now I’m stuck paying out of pocket because my deductible reset. I’m tired. I’m 37. I shouldn’t be fighting for the right to feel okay.

I’ve tried GoodRx. I’ve called customer service. I’ve emailed my reps. I’ve written letters. Nothing changes. They’ll move your drug to tier 4, then tell you to ‘appeal.’ But when you appeal, they say ‘we reviewed clinical data’ - but the data doesn’t include your pain, your sleepless nights, your missed work. They’re not treating a person. They’re treating a cost center.

And now they’re pushing biosimilars without co-pay cards? So you’re supposed to choose between financial ruin and physical suffering? That’s not innovation. That’s exploitation dressed up as efficiency. I don’t want a discount. I want to not be in agony.

My doctor says I need Humira. My insurance says no. So I pay. And I hate that I have to. I hate that this is normal. I hate that I’m supposed to be grateful for a $60 copay when the drug costs $1,300 and I’m the one paying the difference. I’m not a statistic. I’m not a line item. I’m a human being trying to live.

Jenny Rogers

December 18, 2025 AT 04:27One must acknowledge, with due deference to the economic imperatives of modern healthcare administration, that the moral hazard inherent in the current formulary paradigm is not merely a structural flaw - it is an epistemological failure of the patient-provider-insurer triad. The commodification of therapeutic outcomes, while fiscally expedient, undermines the foundational ethos of medical ethics: primum non nocere. The algorithmic prioritization of cost over clinical nuance constitutes a quiet, systemic violence against bodily autonomy.