When you fill a prescription, you might be surprised by the price at the counter-even if you have health insurance. That’s because your plan doesn’t pay everything. You pay part of it. That’s called cost sharing. It’s not just about your monthly premium. It’s about what you pay when you actually use care: doctor visits, lab tests, and especially medications. Understanding deductibles, copays, and coinsurance can save you hundreds-or even thousands-of dollars a year on prescriptions.

What Is Cost Sharing?

Cost sharing is the portion of your healthcare bill that you pay out of your own pocket. It includes deductibles, copays, and coinsurance. Your insurance plan covers the rest. This system exists to keep premiums lower. If insurers paid for everything, your monthly bill would be much higher. So instead, you share the cost when you use services. This also helps discourage unnecessary care. If you know you’ll pay something each time, you’re more likely to think twice before asking for a test or refill you don’t really need.But here’s the catch: many people don’t understand how these pieces fit together. You might think your copay is your only cost. Or you might assume your deductible doesn’t apply to prescriptions. That’s where things go wrong. By 2023, 68% of consumers in U.S. surveys admitted they were confused about how deductibles and out-of-pocket maximums worked. And for people on chronic medications, that confusion can mean unexpected bills-sometimes hundreds of dollars more than expected.

Deductibles: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts helping with costs. For medications, that means you pay 100% of the price until you hit that number. Let’s say your plan has a $1,500 deductible. Every pill you buy, every doctor visit, every lab test-all of it adds up. Once you’ve spent $1,500 on covered services, your insurance kicks in.Some plans apply the deductible to prescriptions right away. Others don’t. High-deductible health plans (HDHPs), which are common for people under 35 or those with employer-sponsored insurance, usually require you to pay full price for meds until you meet the deductible. In 2023, the average individual deductible for a bronze plan was around $7,000. That’s a lot to pay before your insurance helps.

But not all meds count the same. Preventive services-like annual checkups or vaccines-are often covered at 100% even before you meet your deductible. The same isn’t always true for prescriptions. A statin for high cholesterol? You might pay full price. A diabetes test strip? Same thing. Always check your plan’s Summary of Benefits and Coverage (SBC). It’s a short document your insurer must give you. It shows exactly what’s covered and when.

Copays: Flat Fees at the Pharmacy

A copay is a fixed amount you pay when you get a service. For prescriptions, it’s usually a set dollar amount-like $10, $25, or $45-paid at the pharmacy counter. You don’t pay more if the drug costs $300. You just pay the copay.Copays are common in silver and gold plans. They’re less common in bronze plans, which often use coinsurance instead. But here’s the trick: copays often only apply after you’ve met your deductible. Some plans have a “copay after deductible” rule. Others offer copays right away for certain meds, like generics.

For example: Your plan has a $500 deductible and a $10 copay for generic drugs. You buy your blood pressure med. The pharmacy charges $120 for the bottle. If you haven’t met your deductible yet, you pay $120. After you’ve paid $500 in total for covered services, your next refill costs just $10. That’s the copay.

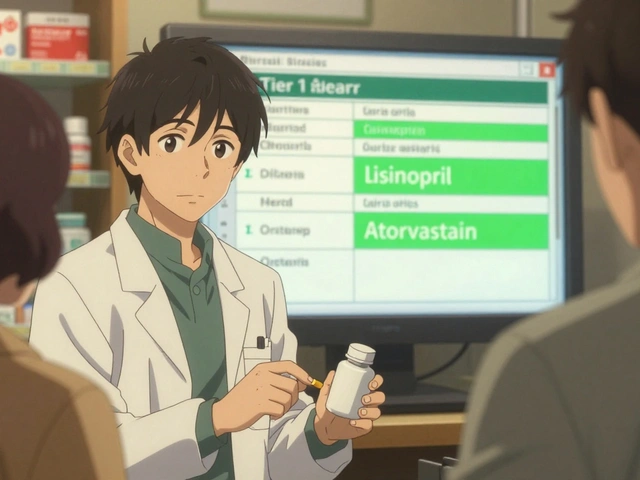

Some plans even have tiered copays. Tier 1: generics-$10. Tier 2: preferred brand-$30. Tier 3: non-preferred brand-$60. Tier 4: specialty drugs-$100 or more. If you’re on a biologic for rheumatoid arthritis or a cancer drug, you could be looking at hundreds per month. That’s why knowing your tier matters.

Coinsurance: Paying a Percentage

Coinsurance is when you pay a percentage of the cost, not a fixed amount. It usually kicks in after you meet your deductible. Let’s say your plan has 20% coinsurance for brand-name drugs. You need a medication that costs $500. After your deductible is met, you pay 20%-$100. Your insurance pays the other $400.Coinsurance can be tricky because the cost of the drug isn’t always what you see on the label. Insurers negotiate prices with pharmacies and drugmakers. That’s called the “allowable amount.” You pay your percentage of that negotiated rate, not the full retail price.

Example: Your insulin costs $300 at the pharmacy. But your insurer’s allowable amount is $120. Your coinsurance is 20%. You pay $24. The insurer pays $96. That’s a big difference from paying $300. Always ask your pharmacist: “What’s the allowable amount for this drug?” That’s the number that matters.

Coinsurance can add up fast. If you’re on multiple specialty meds, you might pay $200 a month-$2,400 a year-just in coinsurance. That’s why knowing your coinsurance rate is critical for budgeting.

Out-of-Pocket Maximum: The Safety Net

All your cost-sharing payments-deductibles, copays, coinsurance-add up toward your out-of-pocket maximum. Once you hit that limit, your insurance pays 100% of covered services for the rest of the year. In 2023, the federal cap was $9,100 for individuals and $18,200 for families.This is your protection. Even if you’re on expensive meds, you won’t pay more than that. But remember: premiums don’t count. Only what you pay directly at the pharmacy or doctor’s office counts toward this cap.

Let’s say you have a $6,000 deductible, 20% coinsurance, and a $9,100 out-of-pocket max. You’re on a specialty drug that costs $1,200 per month. Your allowable amount is $800. You pay 20%: $160. After 19 months of paying $160, you’ve paid $3,040. You’ve also paid $6,000 in deductible. Total so far: $9,040. Next month, you pay $60 to hit your max. After that, your meds are free for the rest of the year.

That’s why tracking your spending matters. Most insurers let you see your out-of-pocket progress online. Check it monthly. If you’re close to your max, you might want to schedule non-emergency care or refills early.

How These Work Together

Think of it like a funnel. First, you pay the deductible-100% of costs. Then, you pay copays or coinsurance. Both count toward your out-of-pocket max. Once you hit that max, you’re done paying for covered services.Here’s a real-life example from someone on a silver plan:

- Deductible: $3,000

- Copay for generics: $10 (after deductible)

- Coinsurance for brand-name drugs: 30%

- Out-of-pocket max: $7,500

They take two meds: one generic ($120/month), one brand-name ($1,500/month, allowable amount $800).

Month 1-3: Pay full price for both meds. Total spent: $3,000. Deductible met.

Month 4: Generic copay = $10. Brand-name coinsurance = 30% of $800 = $240. Total: $250.

Month 5: Same. $250.

By month 18, they’ve paid $250 x 15 = $3,750 on top of the deductible. Total out-of-pocket: $6,750.

Month 19: Pay $750 to hit $7,500 max. After that? Free meds for the rest of the year.

That’s how it works. It’s not complicated. But you have to track it.

What You Can Do Right Now

Don’t wait for a surprise bill. Here’s what to do today:- Find your Summary of Benefits and Coverage (SBC). It’s on your insurer’s website or in your welcome packet.

- Look for “Prescription Drugs.” Note your deductible, copay tiers, coinsurance rate, and out-of-pocket max.

- Call your pharmacy and ask: “What’s the allowable amount for my meds?”

- Log into your insurer’s portal. Check how much you’ve paid so far toward your out-of-pocket max.

- Ask your doctor: “Is there a generic or preferred brand on my plan?”

Many people don’t know their plan has a cost estimator tool. Use it. Compare prices between pharmacies. Some plans let you mail-order meds for lower costs. Others offer discounts for 90-day fills.

And if you’re on insulin? Thanks to the Inflation Reduction Act, Medicare beneficiaries pay no more than $35 a month. That’s a huge change. Check if you qualify.

Common Mistakes

People make the same errors over and over:- Thinking copays apply before the deductible. They usually don’t.

- Believing their out-of-pocket max includes premiums. It doesn’t.

- Not checking if their pharmacy is in-network. Out-of-network costs can double your coinsurance.

- Assuming all drugs are covered. Some plans exclude certain brands or require prior authorization.

One patient in Sydney paid $420 for a thyroid med because they didn’t know it wasn’t on their plan’s formulary. They thought their insurance covered “all prescriptions.” It didn’t. That’s why reading the fine print matters.

Michael Burgess

January 4, 2026 AT 06:51Man, I wish I’d known this stuff before I got hit with a $900 bill for my insulin last year. I thought my copay was it-turns out I hadn’t met my deductible yet. Now I check my insurer’s portal every month like it’s my job. Seriously, if you’re on meds, this is survival info.

And don’t even get me started on how pharmacies lie about the ‘retail price.’ Always ask for the allowable amount. That’s the real number.

Also-90-day fills? Game changer. Saved me $120/month on my asthma inhaler. Just sayin’.

Angela Goree

January 5, 2026 AT 00:44Why do we even have this system?! It’s designed to punish the sick! You pay more the sicker you are, and then they pat themselves on the back for ‘keeping premiums low’? Bull. I’m tired of being financially weaponized because I have a chronic condition.

And don’t tell me ‘it’s for efficiency’-I’ve seen the CEOs make $50M a year while I choose between insulin and groceries. This isn’t healthcare. It’s a racket.

Palesa Makuru

January 5, 2026 AT 03:05Oh sweetie, you’re so cute thinking this is unique to the US. In South Africa, we pay out of pocket for everything-no ‘deductible’ to hide behind, just pure capitalism with a side of despair. You think $35 insulin is a win? Here, insulin is $120 a vial and you pray the pharmacy has stock.

Maybe if you stopped pretending your broken system is ‘fair,’ you’d start demanding real change instead of spreadsheets.

Hank Pannell

January 5, 2026 AT 13:55There’s a deeper epistemological layer here: cost-sharing isn’t merely an economic mechanism-it’s a behavioral nudge engineered to externalize risk onto the individual, thereby redefining ‘health’ as a transactional good rather than a social right.

The deductible functions as a threshold of moral accountability: if you can’t pay, you’re deemed unworthy of care. The coinsurance rate? A quantification of suffering. And the out-of-pocket maximum? A cruel illusion of mercy.

What’s being hidden is not just pricing, but the moral calculus of who deserves to live.

And yet-we still optimize. We still compare tiers. We still check portals. Because survival is a recursive algorithm in a broken system.

veronica guillen giles

January 5, 2026 AT 17:10Oh honey, you’re telling me you didn’t know your plan had a formulary? 😭 I’ve got a 3-year-old with asthma and I’ve memorized every tier like it’s a language. You don’t just ‘check your portal’-you interrogate your pharmacist, beg your doctor for samples, and bribe your insurance rep with Starbucks gift cards.

Also, ‘Inflation Reduction Act’? Please. It’s a Band-Aid on a hemorrhage. But hey, at least now your insulin isn’t a funeral expense. Progress? Maybe. Justice? Nah.

Wren Hamley

January 5, 2026 AT 18:20Let me tell you about my buddy who got hit with a $1,200 bill for his ADHD med. He thought it was covered because it was ‘brand-name.’ Turns out, his plan had a ‘non-preferred’ tier and the pharmacy didn’t tell him. He cried in the parking lot.

That’s the thing-no one explains this stuff. Pharmacies are cash registers with white coats. Docs are overworked. Insurers? They want you to get lost in the fine print.

So yeah-learn your tiers. Call your pharmacy. Ask for the allowable amount. And if you’re lucky? Find a patient advocate. They’re like healthcare ninjas.

innocent massawe

January 7, 2026 AT 06:07Thank you for writing this. In Nigeria, we don’t have insurance like this-so I read this and felt both grateful and sad. Grateful that you have a system (even if broken), sad that it’s so hard to understand. I hope you find peace with your meds. You’re not alone.

❤️

Ian Ring

January 8, 2026 AT 14:02Just wanted to add: if you’re on Medicare, check out Part D Extra Help-it’s not just for low income. Many people qualify without realizing it. I helped my mom get $150/month off her blood pressure meds last year. It’s paperwork, but it’s worth it.

Also-use GoodRx. Always. Even if you have insurance. Sometimes it’s cheaper.

And yes, the system’s a mess. But small wins matter.

Liam Tanner

January 9, 2026 AT 10:16One thing nobody talks about: some plans let you pay your deductible through mail-order pharmacies. I got my 90-day supply of my thyroid med through mail-order, and it counted double toward my deductible. Got to $3k in 3 months instead of 6.

Ask your insurer. They won’t tell you unless you ask.

Also-generic versions? Often just as good. My cardiologist said so. I switched. Saved $200/month.

Sarah Little

January 10, 2026 AT 17:12Did you know that if you’re on a high-deductible plan with an HSA, you can pay for meds with pre-tax dollars? I didn’t either until I got audited last year. Now I max out mine. It’s like free money if you’re on meds.

Also, your pharmacy can sometimes split your prescription-like, 30-day + 60-day-to help you hit your deductible faster. Weird trick, but it works.

erica yabut

January 11, 2026 AT 04:30It’s not rocket science. You just don’t want to do the work. You want your meds to be free and your premiums low and your insurance to magically know what you need. Newsflash: you’re not a child. You have a phone. You have Google. You have a human being at your insurer’s call center.

Stop acting like you’re entitled to transparency. Earn it. Read the SBC. Call. Ask. Then shut up and pay your share. You signed the contract.

Lori Jackson

January 13, 2026 AT 04:04My neighbor’s kid has type 1 diabetes. She pays $40/month for insulin thanks to the IRA. Meanwhile, my husband’s $1,100/month biologic? No help. Why? Because he’s not on Medicare. And we’re not ‘poor enough.’

So the system doesn’t just fail the poor-it punishes the middle class for being too rich to qualify for aid, but too poor to afford care.

This isn’t cost-sharing. It’s class-based medical apartheid.

Michael Burgess

January 13, 2026 AT 10:21Wait-you said your husband’s biologic costs $1,100? I’m on one too. Same drug. My allowable amount is $850. Coinsurance is 20%. So I pay $170. I asked my pharmacist to call the manufacturer for a copay card. Got $200 off per month. Now I pay $170-$200 = -$30. They pay me.

Don’t be shy. Ask for help. Every big pharma has a program. You just have to beg.

And yes-this system is broken. But we’re the ones who have to fix it one prescription at a time.