Ever wonder why your prescription for a generic drug is covered - but another one isn’t, even if they treat the same condition? It’s not random. It’s not arbitrary. It’s a cold, calculated system built around one thing: cost - but not just cost alone.

How Insurers Decide What’s Covered

Insurance companies don’t just pick generics at random. They have teams - called Pharmacy & Therapeutics (P&T) committees - made up of doctors, pharmacists, and data analysts who review every single generic drug before it gets added to a plan’s formulary. These committees don’t work in secret, but they don’t publish their full decision logs either. Only 37% of insurers openly share their exact criteria, according to the Journal of Managed Care & Specialty Pharmacy. The process starts with a basic requirement: the drug must be approved by the FDA. That’s non-negotiable. But approval alone doesn’t mean coverage. The committee then asks three questions:- Is it clinically effective? Does it work as well as the brand-name version in real-world use?

- Is it safe? Does it have fewer side effects or better tolerability than alternatives?

- Is it cost-effective? If two generics do the same thing, but one costs 40% less, which one gets the green light?

Tiers Aren’t Just Labels - They’re Financial Traps

Most insurance plans use 3 to 5 tiers. Here’s how they typically break down:| Tier | Drug Type | Average 30-Day Copay |

|---|---|---|

| Tier 1 | Preferred generics | $0-$15 |

| Tier 2 | Non-preferred generics | $15-$30 |

| Tier 3 | Preferred brand-name drugs | $40-$70 |

| Tier 4 | Non-preferred brand-name drugs | $70-$100+ |

| Tier 5 | Specialty drugs | $100-$500+ |

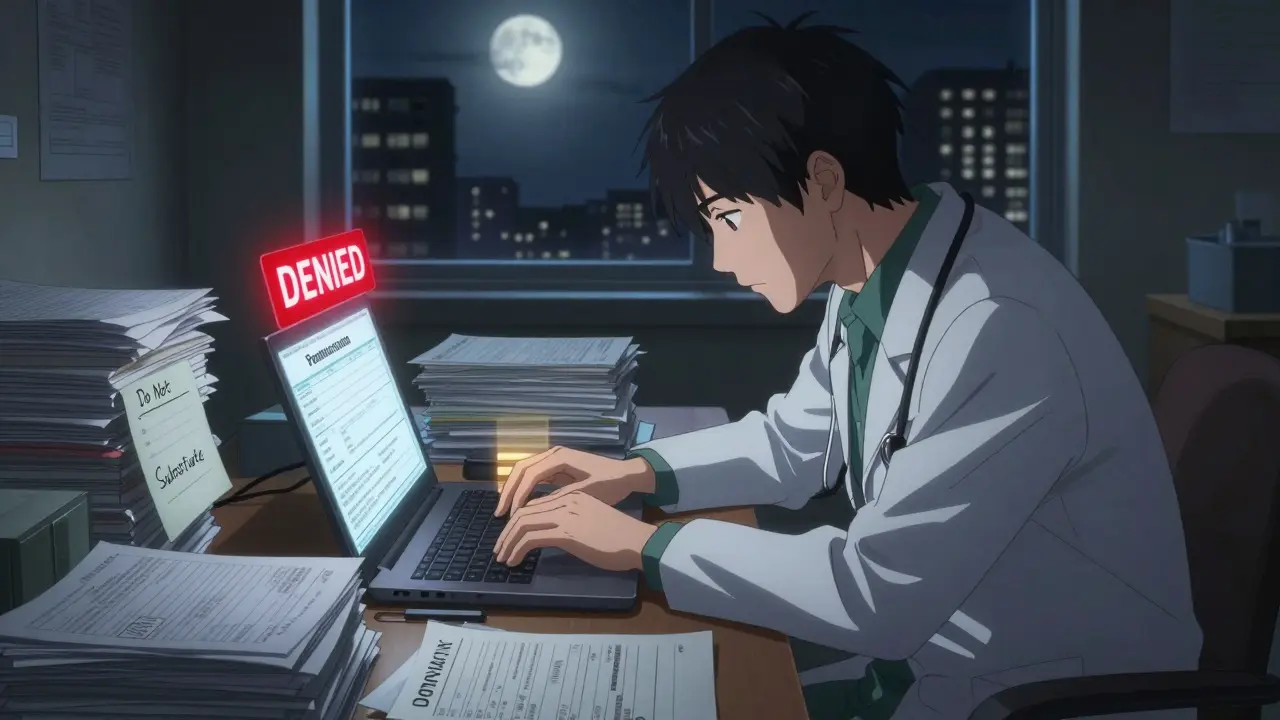

Why Your Doctor Can’t Always Prescribe What They Want

You might think your doctor has full control over your prescription. They don’t. If your doctor writes a script for a non-formulary generic, the pharmacy won’t fill it without a prior authorization. That means your doctor has to call or submit paperwork explaining why the covered generic won’t work for you. The most common reasons for exceptions:- You had a bad reaction to the insurer’s preferred generic

- The generic didn’t control your symptoms

- You’re on a higher dose than the insurer allows

Therapeutic Substitution: When the Pharmacy Changes Your Script

Even if your doctor prescribes a specific generic, your pharmacy might swap it out. This is called therapeutic substitution - and it’s legal in most states. In fact, 78% of commercial insurance plans require pharmacists to substitute a preferred generic if one is available. That sounds fine - until it’s not. A 2023 Drug Topics survey found that 31% of patients reported side effects or reduced effectiveness after being switched to a different generic. Why? Because while generics must contain the same active ingredient, they can differ in fillers, coatings, or release mechanisms. For some patients - especially those with epilepsy, thyroid conditions, or mental health disorders - those tiny differences matter. If you’ve had a bad reaction after a switch, ask your doctor to write “Do Not Substitute” on the prescription. That forces the pharmacy to fill exactly what’s written. But be warned: some insurers will still deny coverage unless you go through the exception process.

What’s Changing in 2025 and Beyond

The landscape is shifting fast. The Inflation Reduction Act of 2022 capped out-of-pocket drug costs for Medicare Part D at $2,000 a year starting in 2025. That’s good news for seniors - but it’s forcing insurers to rethink their strategies. If patients aren’t paying more out of pocket, insurers have to absorb the cost. That means they’ll double down on the cheapest generics possible. The FDA is also speeding up approvals. Thanks to GDUFA III, generic drug approvals are expected to drop from 42 months to 10 months. That means more options will hit the market faster - but insurers will still pick the ones that offer the biggest discount. Meanwhile, AI-driven personalized generics are on the horizon. These are drugs tailored to a patient’s genetics or metabolism. But right now, P&T committees have no framework for evaluating them. A 2023 survey by the Academy of Managed Care Pharmacy found 62% of committee chairs admit they’re unsure how to handle these new drugs. That uncertainty could delay coverage for years.What You Can Do

You’re not powerless in this system. Here’s what actually works:- Always ask your pharmacist: “Is this the preferred generic for my plan?”

- If a generic doesn’t work, tell your doctor - and ask them to file an exception.

- Check your plan’s formulary online before filling a new prescription. Most insurers have searchable lists.

- If you’re on Medicare, use the Medicare Plan Finder tool to compare formularies across plans.

- Don’t assume all generics are the same. If you’ve had issues before, document them and keep copies of your prescriptions.

Why does my insurance cover one generic but not another for the same condition?

Even though two generics treat the same condition, insurers pick one based on cost, safety data, and negotiated discounts. The covered version is usually cheaper or has more real-world use history. The other might be just as effective - but the insurer hasn’t made a deal with its manufacturer.

Can I request a brand-name drug instead of a generic?

Yes - but you’ll pay more. Your doctor can submit an exception request if the generic caused side effects, didn’t work, or you’re on a higher dose than allowed. If approved, you’ll still pay a higher copay, usually in Tier 3 or 4. If denied, you can appeal - and 78% of appeals are eventually approved.

Why does my pharmacy keep switching my generic?

Insurers contract with specific generic manufacturers to get the lowest price. If the pharmacy runs out of the preferred version, they’ll swap it for another approved generic - even if it’s from a different company. This is legal and common. If you’ve had bad reactions before, ask your doctor to write “Do Not Substitute” on the prescription.

Are generic drugs really as good as brand-name ones?

For most people, yes. The FDA requires generics to have the same active ingredient, strength, dosage, and route of administration as the brand. Studies show they work the same in 95% of cases. But for a small group - like those with epilepsy, thyroid disease, or mental health conditions - even tiny differences in inactive ingredients can affect how the drug is absorbed. That’s why some patients need brand-name drugs.

How do I find out which generics my plan covers?

Log into your insurer’s website and look for “Formulary” or “Drug List.” Most have a search tool where you can type in your drug name. Medicare beneficiaries can use the Medicare Plan Finder. Always double-check before filling a new prescription - formularies change every year.

Amy Ehinger

January 14, 2026 AT 14:53So I’ve been on a bunch of generics over the years-blood pressure, thyroid, even antidepressants-and honestly, I’ve noticed weird stuff. Like, one time I switched from one generic omeprazole to another and suddenly I felt like I was running on fumes for two weeks. No idea why. My doctor just shrugged and said ‘they’re the same.’ But they’re not. Not really. The fillers, the coating, the release mechanism-it all adds up. I now always ask the pharmacist which brand they’re dispensing and keep a little notebook. It’s annoying, but it’s saved me from a few bad days.

Also, I love that you mentioned the ‘Do Not Substitute’ note. I wish more people knew that was an option. My pharmacist actually gave me a hard time about it once, like I was being difficult. But hey, my body, my rules.

Frank Geurts

January 15, 2026 AT 18:26It is imperative to underscore, with the utmost clarity, that the pharmaceutical formulary system is not merely a financial construct-it is a meticulously calibrated mechanism of risk mitigation, clinical efficacy optimization, and cost-containment governance. The P&T committees operate under rigorous, evidence-based protocols, which are, in turn, informed by pharmacoeconomic modeling, real-world outcomes data, and contractual obligations with manufacturers.

It is, therefore, a fallacy to assume that cost is the sole determinant. Clinical equivalence, bioavailability profiles, and post-marketing surveillance data are all weighted in a hierarchical fashion. The tiered copay structure is not a punitive measure, but rather a behavioral nudge, designed to align patient incentives with population-level fiscal sustainability. One must not conflate systemic efficiency with malice.

Jami Reynolds

January 16, 2026 AT 12:11Let’s be real-this whole system is rigged. You think the P&T committees are just doctors and pharmacists making ‘science-based’ decisions? Nope. They’re getting kickbacks from big pharma. The ‘cheaper’ generic? It’s the one the manufacturer paid the insurer to promote. The FDA? They approve everything, but they don’t monitor long-term effects. And don’t get me started on how the same company often makes both the brand and the generic-just rebrand it with a different label.

I’ve seen this with my dad’s blood thinner. He got switched to a ‘preferred’ generic and started having nosebleeds. They told him it was ‘coincidental.’ I looked up the manufacturer-same parent company as the brand. Coincidence? I think not.

They’re not saving you money-they’re profiting off your confusion.

RUTH DE OLIVEIRA ALVES

January 16, 2026 AT 21:59Thank you for this comprehensive and meticulously researched overview. The structural analysis of tiered formularies, therapeutic substitution protocols, and the implications of the Inflation Reduction Act is both timely and essential for patient empowerment.

It is noteworthy that the FDA’s GDUFA III initiative, while accelerating generic approvals, simultaneously introduces a new layer of complexity regarding batch-to-batch variability and bioequivalence thresholds. The absence of standardized post-market surveillance for generics remains a critical gap in regulatory oversight.

Patients must be educated not only on formulary access but also on the pharmacological nuances that distinguish generics-particularly in narrow therapeutic index medications. This is not merely a cost issue; it is a pharmacovigilance imperative.

Crystel Ann

January 18, 2026 AT 08:15I just want to say thank you for writing this. I’ve been so frustrated lately trying to figure out why my anxiety med keeps changing. I thought I was going crazy. Turns out, it’s not me-it’s the system. I’m glad someone’s explaining it in a way that doesn’t make me feel dumb for not understanding insurance jargon.

Also, I’m going to start asking my pharmacist about the preferred generic. That’s a small thing, but it feels like a win.

Nat Young

January 19, 2026 AT 19:58Oh wow, so the ‘science’ behind this is just ‘who gave the biggest discount’? Shocking. I bet the P&T committee members all have vacation homes in the Caymans funded by pharma kickbacks. And don’t get me started on ‘therapeutic substitution’-that’s just pharmacy roulette. You’re not a patient, you’re a data point.

Also, ‘92% of Medicare plans put generics in Tier 1’? Yeah, because they know seniors are too tired to fight back. Brilliant business model.

Meanwhile, my neighbor’s kid with epilepsy got switched to a generic and had a seizure. Insurance said ‘it’s the same active ingredient.’ Cool. Let me know when your algorithm dies.

Niki Van den Bossche

January 20, 2026 AT 01:24How quaint-the illusion of clinical neutrality in a system that commodifies bodily autonomy. The P&T committee is not a medical body; it is a tribunal of capital, presiding over the sacrament of the pill as mere fungible commodity.

We have reduced the sacred act of healing to a spreadsheet algorithm, where the soul of pharmacology-individual variation, metabolic idiosyncrasy, the quiet dignity of a body that responds uniquely-is erased in the name of ‘efficiency.’

And yet, we call this progress? This is not healthcare. This is pharmaceutical feudalism, where the patient is serf, the insurer is lord, and the pharmacist is the gatekeeper with a barcode scanner.

ellen adamina

January 20, 2026 AT 06:52I never realized how much power pharmacies have to swap meds. I’ve been on the same generic for years and just assumed it was the same every time. Now I’m worried. What if I’ve been getting different versions and didn’t even notice?

Gloria Montero Puertas

January 21, 2026 AT 20:34Let’s be clear: the fact that you’re even surprised by this means you’ve been willfully naive. The system was designed to extract, not to heal. The ‘preferred’ generic? It’s the one the insurer’s CEO’s brother-in-law’s company manufactures. The ‘non-preferred’? The one that actually works better for you. Coincidence? Or corporate collusion?

And now you’re supposed to be grateful because you’re only paying $15 instead of $100? Please. You’re being manipulated into thinking you’re winning a rigged game. The real winners? The CEOs. The real losers? The people who get sick because their meds suddenly ‘don’t work’ after a switch.

Tom Doan

January 22, 2026 AT 14:07So let me get this straight: we’ve built a healthcare system where the most effective treatment is determined not by clinical outcomes, but by who offered the deepest discount? And we call this innovation?

Meanwhile, doctors spend 13 hours a week on paperwork just to prescribe a drug they’ve been using for decades. And you’re telling me this is ‘smart financial decision-making’?

Brilliant. Let’s outsource empathy to a spreadsheet. Next up: AI deciding which patients get to live based on their deductible.

Annie Choi

January 24, 2026 AT 03:53As a pharmacist in Vancouver, I see this daily. Patients get switched because the insurer’s contract changed. They come in confused, anxious, sometimes panicked. We don’t have the luxury of time to explain bioequivalence thresholds. We just hand them the pill and hope it works.

And yeah-some of those ‘interchangeable’ generics? They’re not. Especially for seizure meds. I’ve had patients cry because their old med is gone and the new one makes them feel like a zombie. We’re not just talking about cost. We’re talking about quality of life.

Someone needs to fix this before someone dies.

Nilesh Khedekar

January 25, 2026 AT 17:46India’s generic drug industry supplies 50% of the world’s low-cost medicines-yet here in the U.S., we’re still fighting over $5 copays? You people have it so easy. In my village, we wait six months for any medicine, and if it’s not on the government list? You pay out of pocket or don’t take it.

At least you have choices. Be grateful. Stop complaining about who made your pill. Focus on the fact that you can get it at all.

Jan Hess

January 27, 2026 AT 14:17This is actually super helpful. I didn’t know you could ask for ‘Do Not Substitute’-I’ve been getting switched for years and thought I had to deal with it. I’m gonna bring this up at my next doctor’s visit. Also, checking the formulary before filling? Genius. I’m gonna start doing that. Thanks for breaking it down so clearly.

Iona Jane

January 28, 2026 AT 00:51They’re watching us. Every time you fill a prescription, they track it. They know if you switch, if you complain, if you ask for an exception. They’re building profiles. Soon, your insurance will deny your meds before you even ask-because your ‘risk score’ says you’re ‘non-compliant’ or ‘high-cost.’

I read a leaked memo last year. They’re testing AI to predict who’ll appeal-and then they auto-deny those people first. Just to see who fights back.

Don’t think you’re just a patient. You’re a data point in a machine that wants you quiet.