Preferred Generic List: What It Is and Why It Matters for Your Health and Wallet

When your doctor writes a prescription, the pharmacy doesn’t always give you the brand name you recognize. Instead, you might get a pill with a different label and a much lower price. That’s because of something called a preferred generic list, a curated list of generic medications approved by your insurance plan or healthcare system as safe, effective, and cost-efficient. Also known as a drug formulary, it’s the backbone of how insurers control costs without sacrificing care. This isn’t a secret list—it’s the reason your $300 brand-name pill gets replaced with a $12 generic version that works just as well.

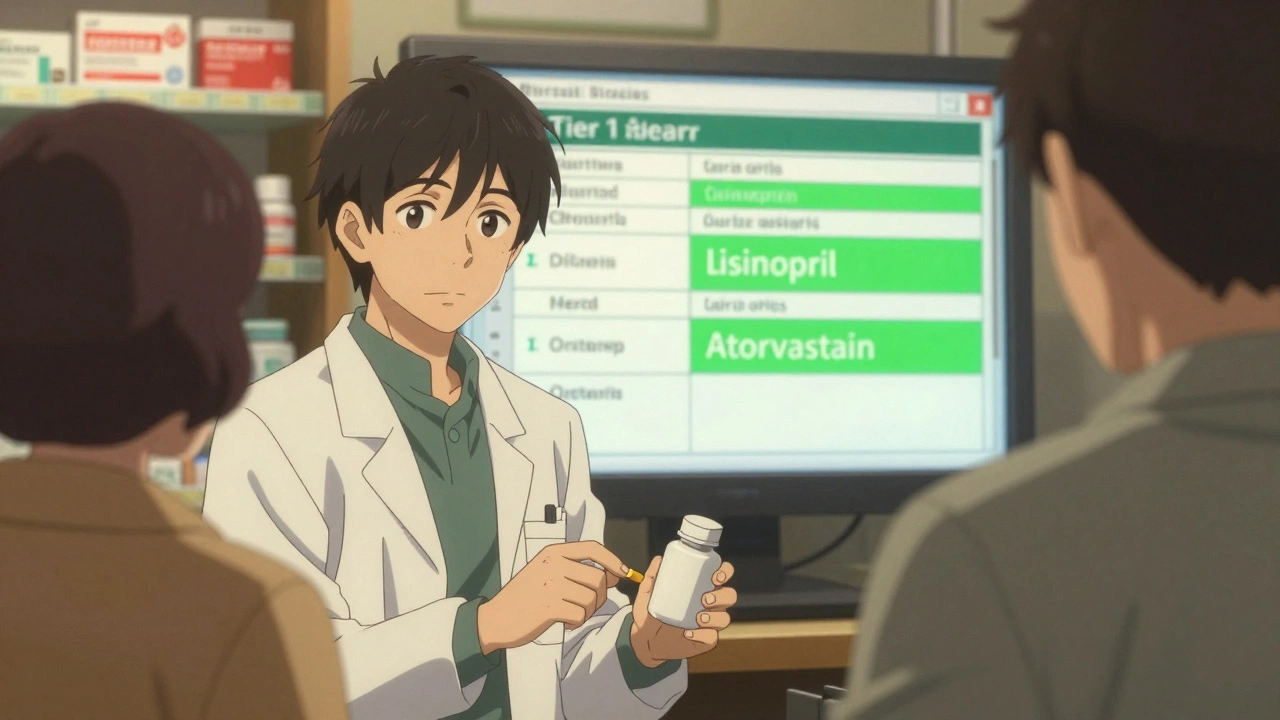

Behind every preferred generic list, a curated list of generic medications approved by your insurance plan or healthcare system as safe, effective, and cost-efficient is a team of pharmacists and doctors who review clinical data, real-world outcomes, and pricing. They don’t just pick the cheapest option—they pick the one proven to work reliably. For example, generic lisinopril for high blood pressure or metformin for diabetes aren’t just cheaper—they’re the gold standard in treatment guidelines. The drug formulary, a list of medications covered by a health plan, often organized by tier and preferred status you’re on might vary by insurer, but the goal is always the same: keep you healthy while keeping costs down. And it works. Generics make up 90% of U.S. prescriptions but cost only 12% of total drug spending. That’s billions saved every year, mostly by people like you.

But here’s the catch: not all generics are treated equally. Some drugs on the list are preferred because they’ve been used for years with no issues. Others are newer, cheaper alternatives that just made the cut. Your plan might push you toward one generic over another—even if they’re both approved by the FDA—because of pricing deals between insurers and manufacturers. That’s why it’s smart to ask your pharmacist: "Is this on my preferred list?" If it’s not, you might pay double or triple. And if you’re switching from a brand to a generic, you’re not taking a risk—you’re making a smart, science-backed move. The FDA requires generics to match brand drugs in strength, safety, and how they work in your body. The only differences? The color, shape, and price tag.

Some people worry generics aren’t as good. But the truth? Most side effects people blame on generics are actually from the nocebo effect—your brain expecting trouble. Studies show when people think they’re taking a brand-name drug, even if it’s a generic, they report fewer side effects. That’s why tools like medication logs, a personal record used to track what drugs you take, when, and how you feel matter. Write down how you feel after switching. If nothing changes, you’re doing fine. If something does, talk to your doctor—not because the generic failed, but because your body might need a tweak.

And it’s not just about saving money. A preferred generic list, a curated list of generic medications approved by your insurance plan or healthcare system as safe, effective, and cost-efficient helps ensure you keep taking your meds. When you can afford them, you’re more likely to stay on them. That’s why people with diabetes, heart disease, or high cholesterol do better long-term when they’re on generics. It’s not magic. It’s access.

Below, you’ll find real stories and practical guides on how generics work, how to spot fake ones, what to do if your insurance denies coverage, and why some drugs never make it onto the list—like those held back by patent tricks or corporate deals. Whether you’re trying to cut costs, avoid side effects, or just understand why your pill looks different this month, you’ll find clear, no-fluff answers here.