Insurance Formulary: What It Is and How It Controls Your Medication Costs

When your health plan says insurance formulary, a list of medications approved for coverage under your plan, often organized by cost tiers and usage rules. Also known as a drug list, it’s not just a catalog—it’s the gatekeeper that decides whether you get your medicine at $5, $50, or $500 a month. Most people don’t realize their doctor’s prescription doesn’t guarantee coverage. The formulary controls everything: which pills your insurer will pay for, which require prior authorization, and which are completely off-limits unless you jump through hoops.

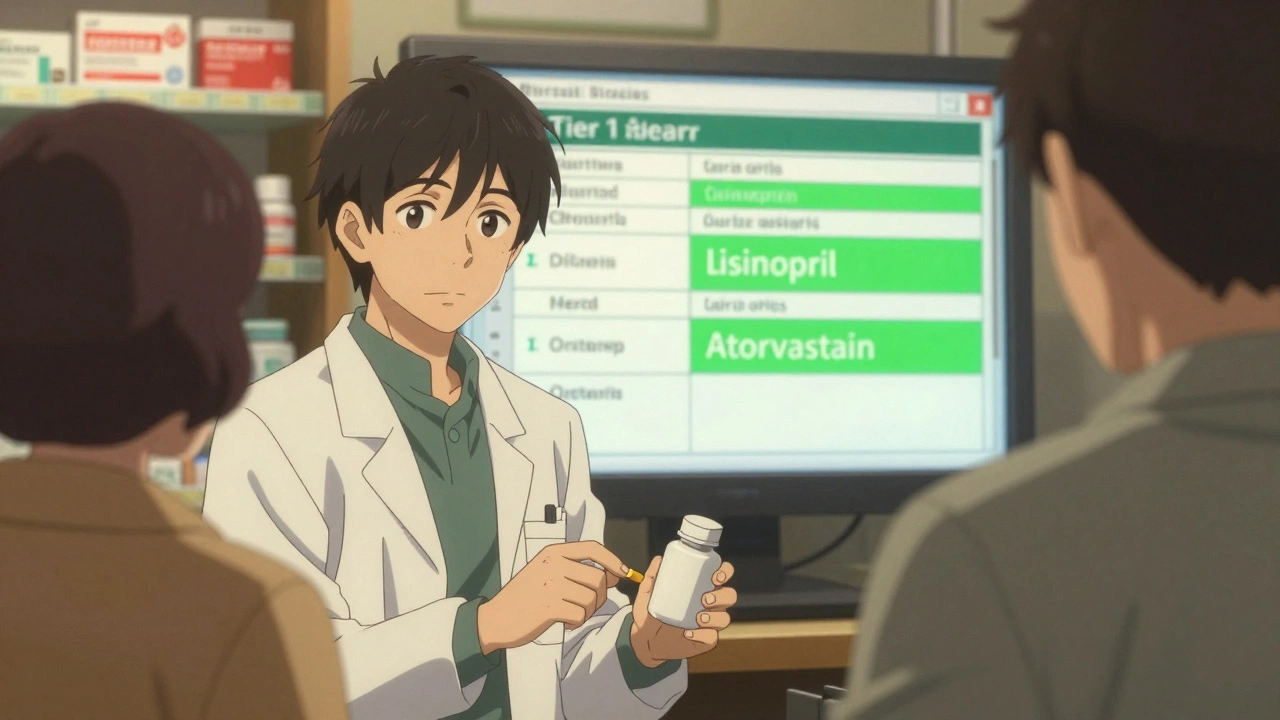

The formulary tiers, a ranking system that groups drugs by cost and preference, with Tier 1 being the cheapest generics and Tier 4 often including specialty brand-name drugs are the real reason your co-pay changes between pharmacies. Tier 1 usually means generic drugs—like those discussed in posts about generic drugs, medications approved as bioequivalent to brand-name versions, often saving patients up to 80% on prescription costs—and that’s why so many articles here focus on how generics slash costs without sacrificing safety. But if your drug isn’t on Tier 1, your insurer might force you to try cheaper alternatives first. That’s called step therapy, and it’s everywhere. You might be prescribed a brand-name statin, only to find out your formulary requires you to try a generic version first—even if your doctor says it won’t work for you.

And it’s not just about price. drug coverage, the specific set of medications an insurance plan agrees to pay for, often limited by clinical guidelines, cost, and manufacturer agreements is shaped by deals between insurers and drugmakers. Some companies pay rebates to get their drugs placed on preferred tiers, while others get pushed to the bottom—or left off entirely. That’s why you’ll see posts about evergreening, a tactic used by pharmaceutical companies to extend patents by making minor changes to old drugs, delaying generic competition and keeping prices high and how it ties directly into formulary decisions. If a brand-name drug is still under patent, insurers are more likely to block generics, even when they’re cheaper and equally effective.

Your formulary can change at any time—sometimes with no warning. A drug you’ve been taking for years might suddenly require prior authorization, or get moved to a higher tier with a bigger co-pay. That’s why knowing your formulary isn’t a one-time task. It’s part of managing your health. The posts below show you how to check your plan’s list, how to appeal a denial, and how to find alternatives that your insurer actually covers. You’ll learn how to use tools like the FDA Orange Book to verify generic equivalents, how to spot when a drug was pulled from formulary due to cost, and how to work with your pharmacist to avoid surprise bills. Whether you’re on insulin, statins, or a new pain med, your formulary is the invisible hand shaping your treatment. Understand it, and you take back control.