Insurance Coverage: Understanding Your Medication Benefits

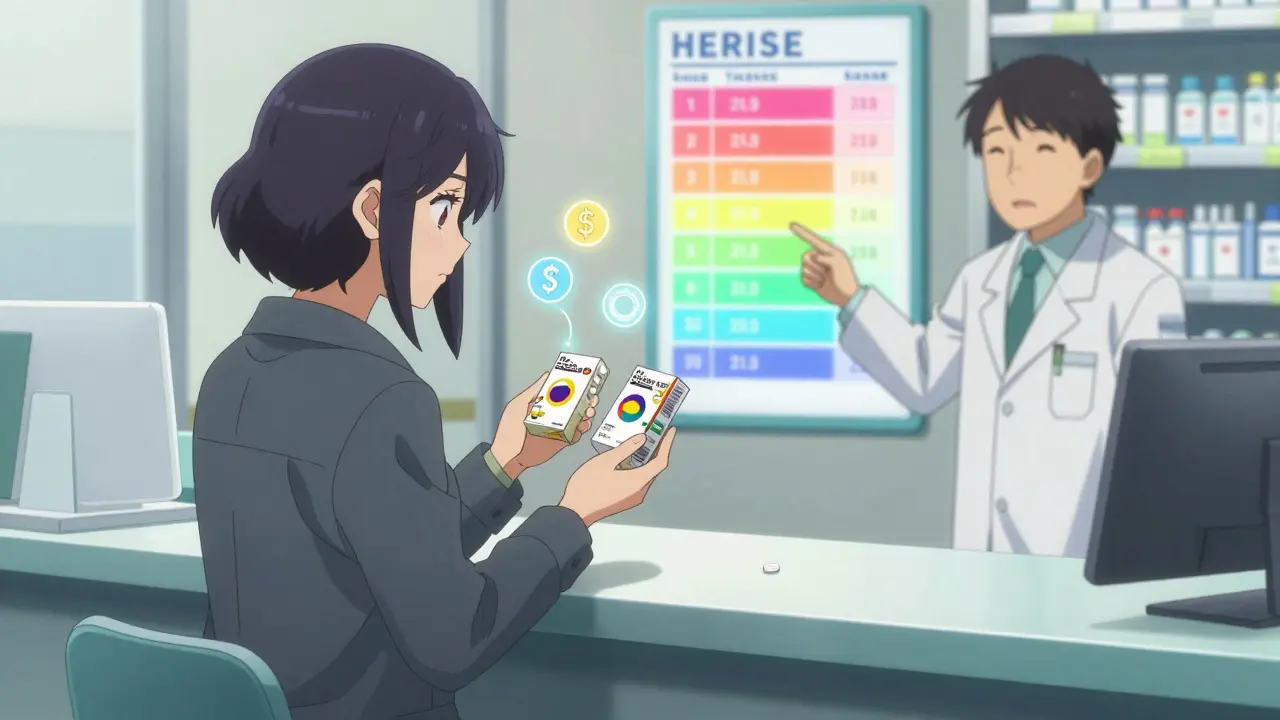

Ever wonder why your medication costs change depending on where or how you buy them? A lot of that has to do with your insurance coverage. Simply put, insurance coverage is what helps pay for your medications so you don’t have to cover the full cost out of pocket. But it’s not always straightforward—different plans cover different drugs, and costs can vary widely.

When you have health insurance, your plan usually includes prescription drug coverage, which means they pay a portion of your medication costs. This reduces how much you pay directly—but exactly how much depends on your plan’s rules and restrictions. Some drugs are fully covered, others partially, and some might not be covered at all.

How Does Insurance Coverage Affect Your Pharmacy Experience?

Think about the last time you got a prescription. If your medication is on your insurer’s preferred list (called a formulary), you’ll likely pay less. If it’s not, you might pay more or have to try alternatives first. Before you fill a prescription, it’s smart to check with your insurance to see if your medication is covered and what your expected share of the cost will be.

Besides drug coverage, your insurance plan includes other factors that impact what you pay, like deductibles, copays, and coinsurance. Deductibles mean you pay full price until you hit a certain amount in a year, copays are fixed fees per medication, and coinsurance is a percentage of the drug cost. These all affect your final price at the pharmacy.

Tips for Managing Medication Costs Through Insurance

Want to keep your medication costs in check? Start by understanding your plan’s formulary and coverage limits. Don’t hesitate to ask your doctor about generic options or alternatives that might be cheaper and still effective. Also, many pharmacies offer savings programs or discount cards that can work alongside your insurance to lower costs.

If you’re using online pharmacies, check whether your insurance will cover those purchases. Some insurance plans only cover medications bought at in-network pharmacies or from approved mail-order providers. Getting this info upfront can save you unexpected bills later.

Insurance coverage can seem complicated, but taking a bit of time to learn how your plan handles prescriptions can make a big difference. Knowing what’s covered and how much you’ll pay helps you avoid surprises and keeps your healthcare affordable.