When you pick up a prescription, you might be handed a small white pill with a code on it instead of the brand-name box you expected. That’s not a mistake-it’s how your insurance plan works. Generic drugs are the backbone of modern pharmacy coverage, saving patients and insurers billions every year. But understanding the difference between generics and brand-name drugs isn’t just about price. It’s about how your insurance decides what you pay, what you get, and when you might be forced to switch.

Why Insurance Pushes Generics

Insurance companies don’t pick generics because they’re cheaper to make-they pick them because they’re cheaper for you. A 30-day supply of a generic blood pressure pill might cost you $5. The brand version? $85. That’s not a typo. The active ingredient is identical. The FDA requires generics to match brand-name drugs in strength, dosage, safety, and effectiveness. But generics skip the massive R&D costs, marketing budgets, and patent protections that make brand drugs expensive. Most insurance plans use a tiered system called a formulary. Generics sit on Tier 1-the lowest cost tier. Brand-name drugs without a generic alternative land on Tier 3 or 4, with copays that can be 5 to 10 times higher. In 2022, 90% of all prescriptions filled in the U.S. were generics. That’s not because doctors prefer them-it’s because insurance makes it almost impossible not to.How Your Insurance Forces the Switch

If a generic version of your medication exists, your pharmacist is legally allowed-and often required-to swap it in unless your doctor writes "Do Not Substitute" on the prescription. This is called automatic substitution. It’s legal in all 50 states, but the rules vary. Some states require the pharmacist to notify you. Others let them switch without even telling you. Here’s where it gets tricky: if you insist on the brand-name drug even when a generic is available, you don’t just pay the higher copay. You pay the generic copay plus the full price difference. So if your generic copay is $10 and the brand costs $80, you pay $10 + $70 = $80. That’s not a discount. That’s a penalty. Medicare Part D plans take this further. They mandate substitution unless a doctor proves medical necessity. In 2022, 91% of all Medicare Part D prescriptions were generics. That’s not coincidence-it’s policy.When Brand-Name Drugs Get Special Treatment

Not all drugs are treated equally. For medications with a narrow therapeutic index-like warfarin, levothyroxine, or phenytoin-small changes in formulation can have big effects. These drugs need to stay within a tight range in your bloodstream. Too little, and it doesn’t work. Too much, and you risk serious side effects. Twenty-seven states have special rules for these drugs. In California, if a generic causes side effects, your insurer must cover the brand version. In Texas, brand-name coverage is only allowed if no generic equivalent exists. Other states require your doctor to file paperwork proving you’ve tried and failed at least three generics before approving the brand. Even then, it’s not guaranteed. Prior authorization for a brand-name drug when a generic exists can take up to 3.2 business days. Forty-one percent of these requests need a second call from the doctor. That’s days without medication. For someone managing epilepsy, heart failure, or depression, that delay can be dangerous.

Why Some Patients Still Struggle

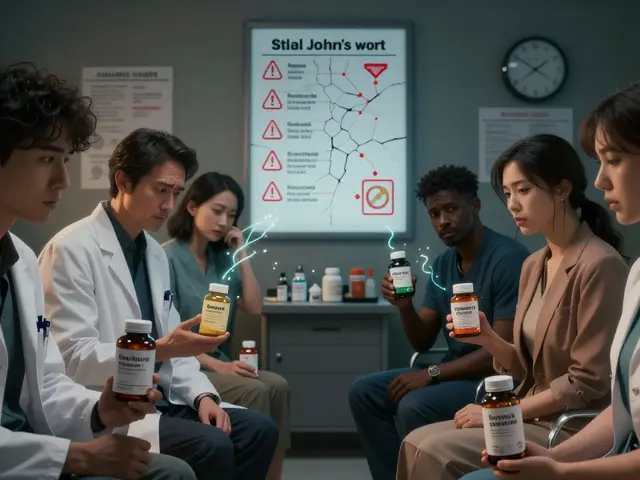

The science says generics are equivalent. But real people report different experiences. On forums like Drugs.com, thousands of users describe sudden anxiety, fatigue, or seizures after switching from brand to generic versions of drugs like Wellbutrin XL, Concerta, or Lamictal. The active ingredient is the same. But the fillers-dyes, binders, coatings-are not. And for some people, those inactive ingredients matter. A 2022 study in JAMA Neurology found that patients with epilepsy had a 12.3% higher rate of seizures after switching to generics. That’s not a small number. It’s enough to make doctors cautious. The FDA says generics are just as safe. But a 2022 survey from Brigham and Women’s Hospital found that 68% of physicians have patients who report side effects after switching to generics-even when the active ingredient hasn’t changed. That’s why some doctors still write "Do Not Substitute" on prescriptions. It’s not about distrust in science. It’s about distrust in the system.What You Can Do If You’re Forced to Switch

If your insurance switches your medication and you feel worse, you have options:- Ask your doctor to write "Do Not Substitute" on the prescription. This stops automatic switching.

- Request a prior authorization for the brand-name drug. Your doctor must document why the generic didn’t work-side effects, loss of effectiveness, or allergic reaction to inactive ingredients.

- File an appeal. Most insurers have a 30-day window to challenge coverage decisions.

- Check if your drug manufacturer offers a copay card. Many brand-name companies give you a card that reduces your out-of-pocket to $0 or $10. But here’s the catch: these cards are illegal for Medicare and Medicaid patients.

The Bigger Picture: Costs, Innovation, and Fairness

Generics saved the U.S. healthcare system $2.2 trillion over the last decade. That’s money that went to hospitals, nurses, and patients who couldn’t afford care. But there’s a trade-off. The Congressional Budget Office estimates that if we push generics too hard, pharmaceutical innovation could drop by 4.7%. Companies need profits to fund new drugs. If every drug becomes a generic overnight, who pays for the next breakthrough? The Inflation Reduction Act of 2022 tried to balance this. It capped out-of-pocket drug costs for Medicare beneficiaries at $2,000 a year. That helps people on expensive brand-name drugs. But it doesn’t fix the system that forces them to jump through hoops just to get what works. Meanwhile, the market is changing. Big pharma now sells "authorized generics"-their own brand-name drugs made as generics by their own factories. These often get better coverage than third-party generics because insurers trust the same manufacturer. So even the system has loopholes.What You Need to Know Before Your Next Prescription

- If your drug has a generic, expect to get it unless your doctor says otherwise. - Ask your pharmacist: "Is this a generic? What’s the brand name?" Don’t assume. - If you feel different after a switch, tell your doctor immediately. Don’t wait. Don’t suffer in silence. - Keep a list of all your medications-brand and generic-and note any side effects. - Check your plan’s formulary online. Most insurers let you search by drug name and see what tier it’s on. - If you’re on Medicare, use the Plan Finder tool. It shows you exactly what you’ll pay for each drug. Insurance isn’t trying to hurt you. It’s trying to save money. But money shouldn’t be the only thing that decides what goes into your body. You deserve to know how the system works-and when to push back.Are generic drugs really the same as brand-name drugs?

Yes, by law. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also meet the same standards for safety, purity, and effectiveness. But the inactive ingredients-like fillers and dyes-can differ. For most people, that doesn’t matter. For a small number, those differences cause side effects or reduced effectiveness.

Why do I pay more if I choose the brand-name drug when a generic is available?

Insurance plans use a system called "preferred drug pricing." If a generic exists, they set a low copay for it. If you choose the brand, you pay the generic copay plus the full difference in price between the brand and generic. For example, if the generic costs $10 and the brand costs $80, you pay $10 + $70 = $80. This isn’t a discount-it’s a financial penalty designed to encourage generic use.

Can my pharmacist switch my medication without telling me?

In most states, yes. Pharmacists are allowed-and sometimes required-to substitute a generic for a brand-name drug unless the doctor writes "Do Not Substitute" on the prescription. Some states require them to notify you, but many don’t. Always check the pill and the label when you pick up your prescription.

What if the generic doesn’t work for me?

If you notice new side effects, reduced effectiveness, or worsening symptoms after switching to a generic, tell your doctor right away. They can file a prior authorization request for the brand-name drug, often requiring documentation of failed trials with generics. In some states, like California, insurers must cover the brand if the generic causes adverse reactions.

Why do some doctors refuse to prescribe generics?

Most doctors support generics-they’re safe and cost-effective. But some avoid them for medications with narrow therapeutic windows, like thyroid or seizure drugs, where small changes in formulation can have big effects. Others write "Do Not Substitute" because they’ve seen patients have bad reactions. It’s not about distrust in science-it’s about trusting their patients’ experience.

Are there any drugs that don’t have generics?

Yes. Many newer drugs, especially biologics and specialty medications, don’t have generics yet because of complex manufacturing and patent protections. These include drugs for cancer, rheumatoid arthritis, and multiple sclerosis. Instead, you may see "biosimilars," which are similar but not identical to the brand. Coverage for these is still evolving and often requires more paperwork.

Can I use a manufacturer’s copay card to lower the cost of a brand-name drug?

Yes-if you have commercial insurance. Many brand-name drug makers offer copay cards that reduce your cost to $0 or $10. But these cards are illegal for Medicare and Medicaid patients under federal law. If you’re on Medicare, you can’t use them. Some patients try to use them anyway, but that can lead to penalties or loss of benefits.

How do I know if my insurance plan has a preferred generic?

Check your plan’s formulary online. Most insurers have a search tool where you can enter your drug name and see what tier it’s on and whether a generic is preferred. You can also call your insurer’s pharmacy help line. Ask: "Is there a generic version of this drug? If so, what’s my copay for the generic versus the brand?" Don’t guess-get the facts before you fill the prescription.

Madhav Malhotra

January 12, 2026 AT 07:42Man, this hits different in India. We don’t even have brand-name drugs most of the time-everything’s generic, and folks still get treated fine. But yeah, I’ve seen people freak out when they get a different-looking pill. It’s all about trust, not science.

Priya Patel

January 12, 2026 AT 16:17My mom switched from brand Levothyroxine to generic and started feeling like a zombie. Took 3 months and 2 doctors to get the brand back. Insurance didn’t care. She’s fine now, but why does it have to be a battle? 😔

Alex Smith

January 13, 2026 AT 19:48So let me get this straight-you’re telling me the FDA says generics are identical, but 68% of doctors have patients who swear they’re not? Sounds like the system’s got a glitch, not the science. 🤔

Michael Patterson

January 15, 2026 AT 03:44Generics are fine for people who don't care about their health. I've been on the same brand of Wellbutrin for 12 years. Switched once, had panic attacks for a week. My doctor wrote 'Do Not Substitute' in blood. Literally. (He's a cool guy.)

Matthew Miller

January 15, 2026 AT 20:59Stop acting like insurance is the villain. They're just following the math. You want brand-name? Pay for it. Don't cry because your $85 pill got replaced with a $5 one that does the exact same thing. Your anxiety is a product of capitalism, not pharmacology.

Vincent Clarizio

January 17, 2026 AT 19:21Look, I get it-science says they’re the same. But here’s the thing: your body isn’t a lab. It’s a living, breathing, emotionally scarred organism that remembers every pill it’s ever swallowed. The fillers? They’re not inert. They’re cultural artifacts-colorants from decades of pharmaceutical marketing, binders shaped by corporate supply chains, coatings that whisper ‘you’re not special’ in chemical form. And when you switch from the pill you’ve trusted since your 20s to a white oval that looks like it was pressed by a vending machine in a Walmart parking lot… your nervous system doesn’t care about bioequivalence. It cares about continuity. It cares about identity. It cares about the fact that you’ve survived on this one pill, through breakups, job losses, funerals, and 3 a.m. panic attacks-and now it’s been replaced with a knockoff. That’s not pharmacology. That’s existential erasure. And no, I’m not overreacting. I’m just being honest about how human bodies actually respond to the world.

Roshan Joy

January 19, 2026 AT 00:30Good breakdown! Just wanted to add-here in India, even generics have different brands (like Cipla, Sun Pharma) and people get super loyal to one. My uncle swears by Cipla’s generic Lamictal. Says the others give him headaches. So even within generics, there’s trust factors. 🙌

Priscilla Kraft

January 20, 2026 AT 14:31My pharmacist switched my Concerta without telling me. I didn’t notice until I couldn’t focus for 3 days. I called my doctor, he called the insurance, and they approved the brand after 5 days. I cried. Not because I’m dramatic-I’m just tired of being treated like a cost center. 🤍

Sam Davies

January 21, 2026 AT 07:50Oh wow, so we’ve turned medicine into a game of ‘guess which white pill is the real you’? Brilliant. Next they’ll be auctioning off your antidepressants based on your zip code. 🥂

Alfred Schmidt

January 21, 2026 AT 23:28You people are so naive. The FDA doesn’t care about you. They’re paid off by Big Pharma. Generics are dangerous. I’ve seen people die from ‘equivalent’ drugs. And now you’re just gonna trust a $5 pill because some bureaucrat said it’s ‘the same’? Wake up. Your life is a commodity.

Christian Basel

January 23, 2026 AT 19:02Formulary tiering is a classic utilization management tactic-essentially a form of price discrimination disguised as cost containment. The real issue is the lack of regulatory harmonization around inactive ingredients across generic manufacturers. The FDA’s bioequivalence thresholds are too permissive for narrow TI drugs. We need a tiered generic classification system-not just ‘generic’ vs ‘brand.’