Drug Tiers Explained: How Insurance Plans Sort Your Medications

When you pick up a prescription, the price you pay isn’t just about the drug—it’s about drug tiers, a system insurance companies use to categorize medications by cost and coverage. Also known as a formulary, this tier structure decides whether your pill costs $5, $30, or $100 at the pharmacy. It’s not random. Every drug your insurer covers is placed in a tier based on price, effectiveness, and whether a cheaper version exists. You might not see it, but drug tiers are quietly shaping your healthcare bills.

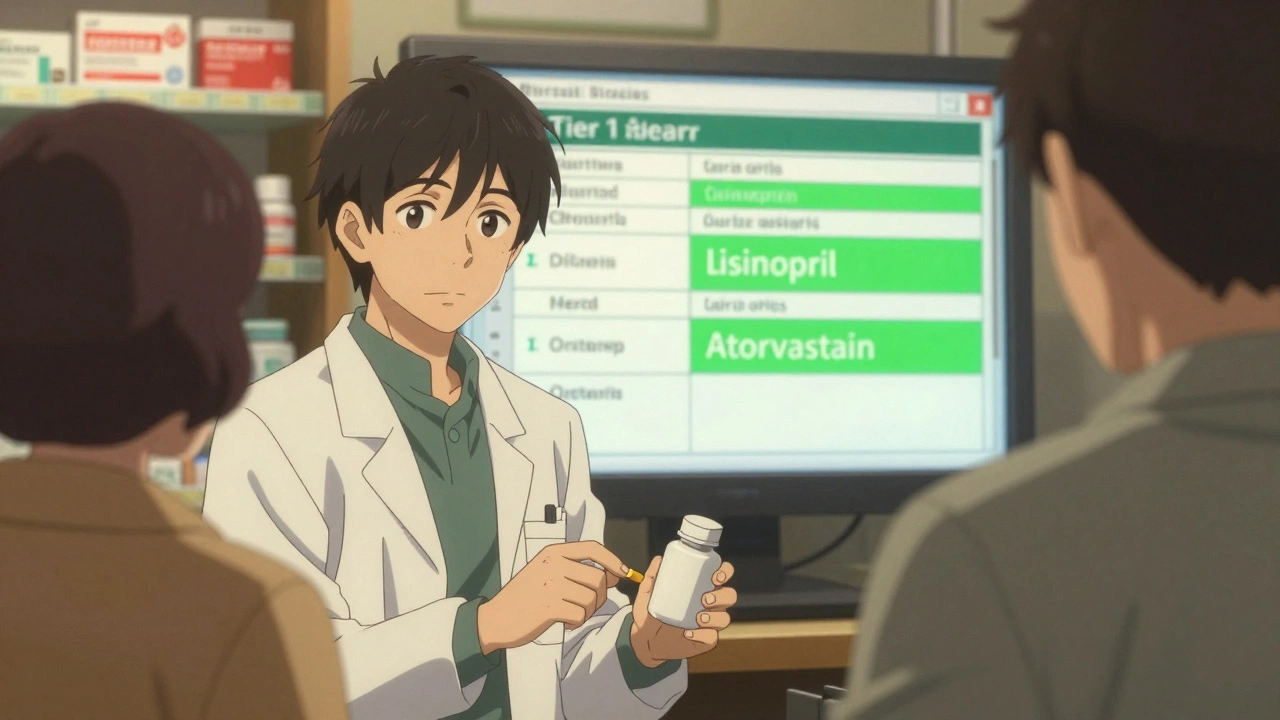

Most plans have four to five tiers. Tier 1 is usually generic drugs—like metformin for diabetes or lisinopril for blood pressure. These are cheap because they’ve lost patent protection. Tier 2 includes preferred brand-name drugs, often newer or more targeted. Tier 3 is non-preferred brands, which cost more because insurers want you to try cheaper options first. Tier 4? That’s specialty drugs—things like injectables for rheumatoid arthritis or cancer treatments. These can run hundreds or thousands of dollars, and often need pre-approval. And if your drug isn’t on the list at all? You pay full price. That’s why knowing your plan’s formulary matters as much as knowing your dose.

Drug tiers don’t just affect your wallet—they influence what doctors prescribe. If your insurer puts a statin like simvastatin in Tier 1 but the newer rosuvastatin in Tier 3, your doctor might switch you even if you’re doing fine. It’s not about what’s best for you—it’s about what’s cheapest for the insurer. But here’s the twist: sometimes, the cheaper tier drug causes more side effects. That’s why understanding generic drugs, medications that are chemically identical to brand-name versions but sold at lower prices is key. Many people think generics are inferior, but FDA data shows they work just as well. The real issue? Some insurers push generics even when they’re not the right fit, or they change tiers without warning. You could be paying $5 for a drug one month, then $80 the next because it moved to Tier 4.

And it’s not just about price. Drug tiers are tied to access. If your medication is on a high tier, you might need prior authorization, step therapy, or quantity limits. That means you have to try two cheaper drugs first before they’ll cover the one your doctor actually prescribed. This is where medication access, the ability to get the right drug at the right time without unnecessary barriers becomes a real struggle. People skip doses, delay refills, or stop treatment altogether because they can’t afford the tier price. It’s not just inconvenient—it’s dangerous.

What you’ll find in these articles isn’t theory. It’s real-world fixes. You’ll learn how to check your plan’s formulary without calling customer service, how to fight a tier change, and which drugs are most likely to be moved to higher tiers (spoiler: it’s often the ones you depend on). We’ll show you how to use tools like the FDA Orange Book and DailyMed to verify if your drug has a generic alternative. You’ll see how evergreening tactics by drug companies push older meds into higher tiers, and how TRIPS treaty rules limit global access to affordable versions. There’s even a guide on spotting counterfeit generics—because when you’re forced into a high-tier drug, scammers see an opportunity.

Drug tiers are designed to control costs—but they shouldn’t control your health. The goal here isn’t to explain insurance jargon. It’s to give you the power to push back. Whether you’re on a statin, a diabetes pill, or a specialty injectable, you deserve to know why you’re paying what you’re paying—and how to pay less without sacrificing safety.